Foreigners can check their personal tax code in Vietnam through 5 main methods: official General Department of Taxation website, eTax Mobile app, third-party websites like masothue.com, Facebook Messenger, and directly at tax offices. From July 1, 2025, foreigners still use separate 10-digit tax codes instead of personal identification numbers like Vietnamese citizens.

Important Note: Foreigners present in Vietnam for 183 days or more per year or those with income generated in Vietnam must register and obtain a personal tax code. This regulation applies to all foreigners working legally in Vietnam, from experts and engineers to skilled workers. To better understand specific tax calculations, refer to Exchange Rate Rules for Foreign Workers’ Personal Income Tax in Vietnam [2025] with detailed formulas and illustrative examples.

Do Foreigners Need a Personal Tax Code in Vietnam?

Yes, foreigners are required to have a personal tax code when meeting residency conditions or having income in Vietnam. According to Consolidated Document No. 68/VBHN-BTC, resident individuals are those present in Vietnam for 183 days or more within a calendar year or 12 consecutive months.

Mandatory Registration Conditions

Cases requiring registration:

- Residency duration: 183 days or more in a calendar year or 12 consecutive months

- Income generation: Any income arising in Vietnam (salary, bonuses, commissions)

- Residence permits: Holding temporary or permanent residence cards issued by the Ministry of Public Security

- Employment contracts: With Vietnamese companies or enterprises

Important Changes from July 1, 2025

From July 1, 2025, foreigners in Vietnam continue to use separate 10-digit tax codes, not switching to personal identification numbers like Vietnamese citizens. This means:

- Vietnamese citizens: Use 12-digit personal identification numbers instead of tax codes

- Foreigners: Continue using separately issued 10-digit tax codes

- New registrations: Foreigners still must register tax codes through tax offices or income-paying organizations

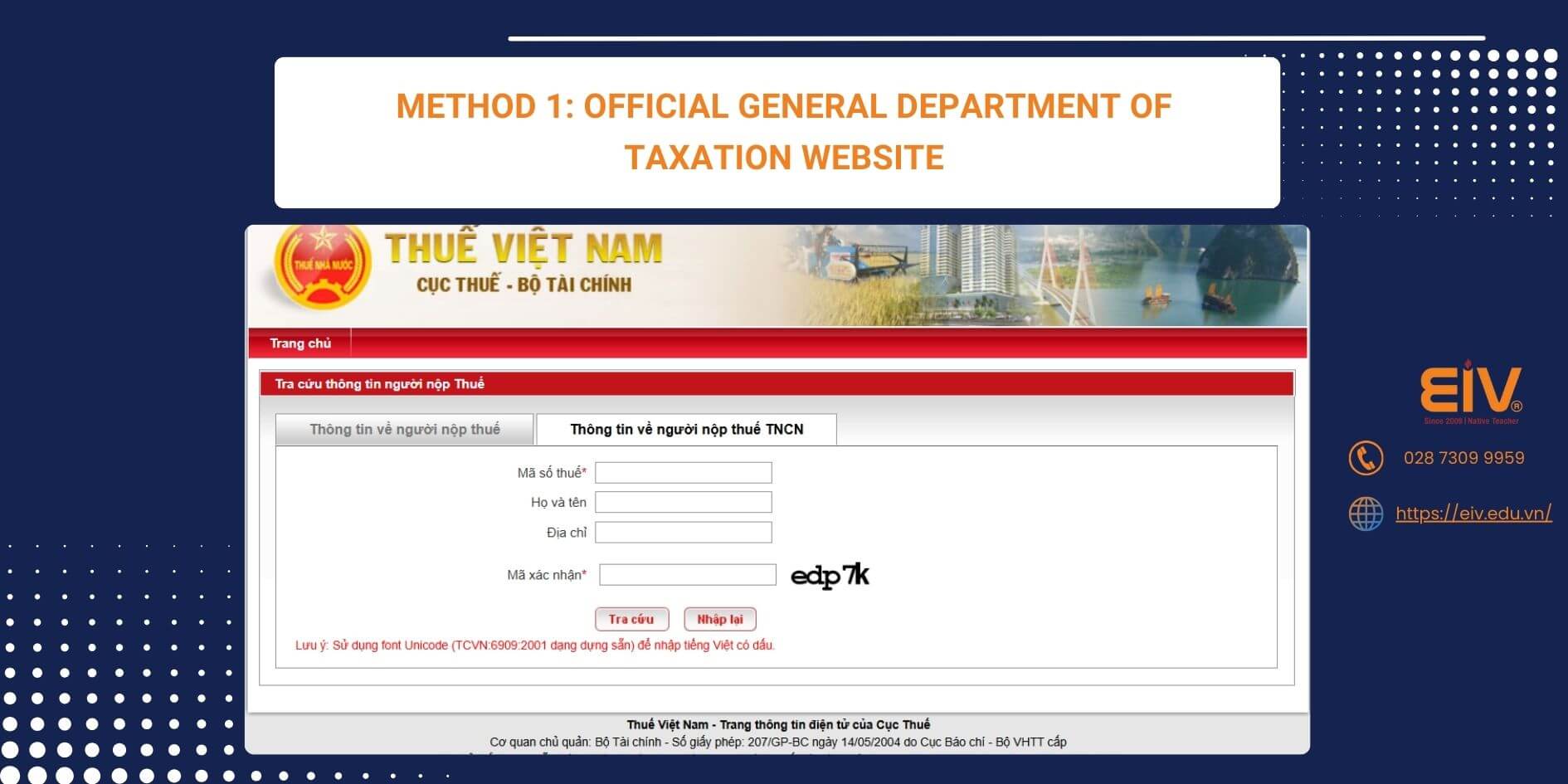

Method 1: Official General Department of Taxation Website

The official website http://tracuunnt.gdt.gov.vn/tcnnt/mstcn.jsp is the most accurate and free lookup method. This is the official information portal of the General Department of Taxation – Ministry of Finance.

Detailed 4-Step Guide

Step 1: Access the official website

- Open browser and visit: http://tracuunnt.gdt.gov.vn/tcnnt/mstcn.jsp

- Select “Information about Personal Income Tax payers” tab

Step 2: Enter lookup information

- ID card/Citizen ID number: Enter passport number or CCCD (if available)

- Verification code: Enter exact character string distinguishing uppercase and lowercase

- Important note: Leave 3 fields blank: Tax code, full name, address. If you fill information in these fields, the system will show “No results found”

Step 3: Perform lookup

- Click “Lookup” button and wait for results to display

- If you need details, click “View” and re-enter verification code

Step 4: Receive results System displays information:

- Tax code: Unique 10-digit string

- Taxpayer name: Full name

- Managing tax office: Responsible tax sub-department

- Issue date: When tax code was issued

- Status: Active/Suspended/Locked

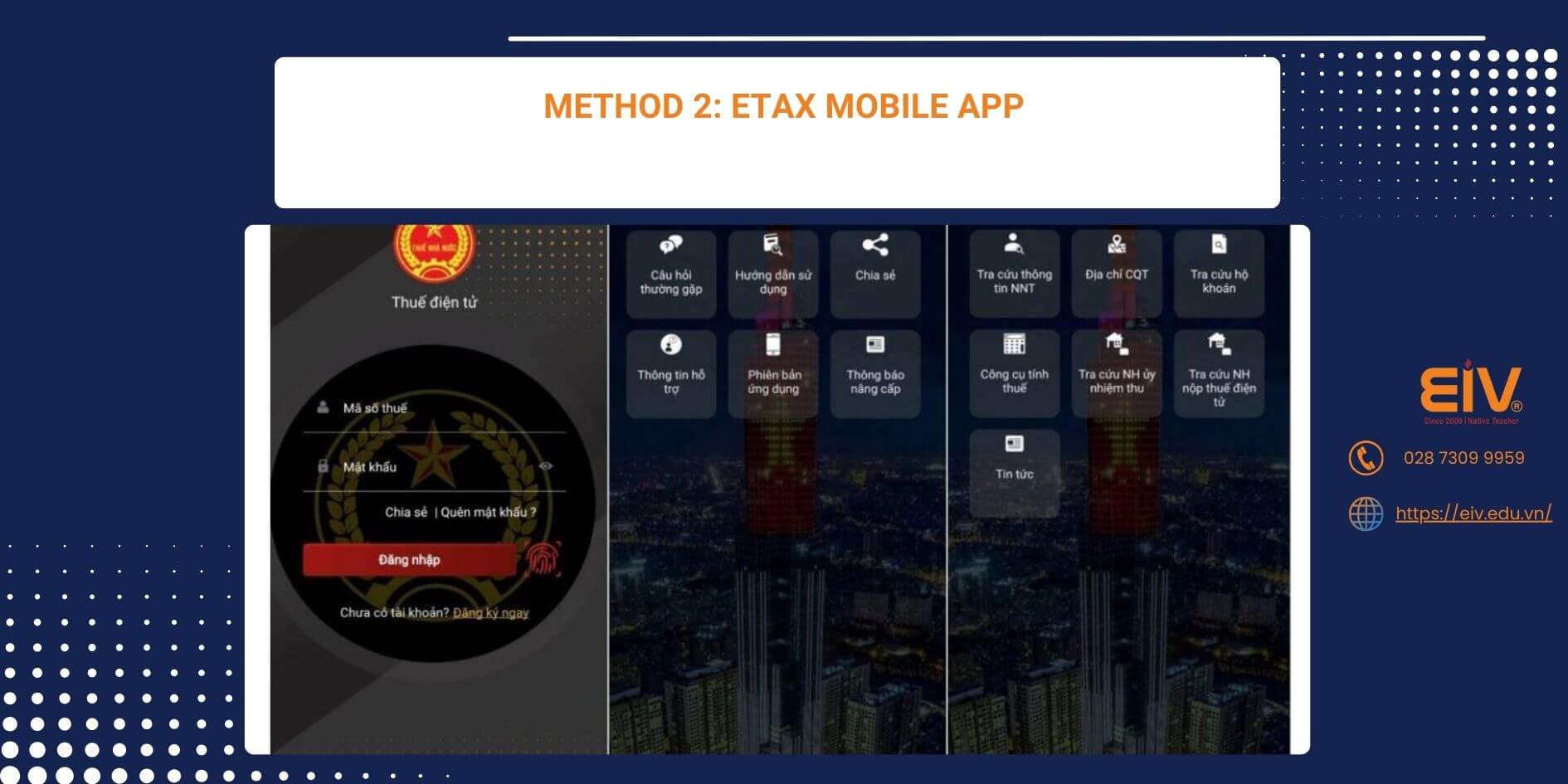

Method 2: eTax Mobile App

The eTax Mobile app from the General Department of Taxation allows tax code lookup anytime, anywhere with just internet connection. eTax Mobile supports both iOS and Android operating systems (version 6.0 and above).

6-Step Mobile Process

Step 1: Download the app

- iOS: Search “eTax Mobile” on App Store

- Android: Search “eTax Mobile” on Google Play Store

- Download and install free

Step 2: Open app and access function

- Open eTax Mobile app

- Tap “Utilities” then select “Lookup taxpayer information”

- No login required for information lookup

Step 3: Select document type

- Document type: Choose “Citizen ID” or “Passport”

- Document number: Enter passport number or CCCD/CMND

Step 4: Enter verification code

- Verification code: Enter exact character string (distinguishing uppercase and lowercase)

- Confirm information accuracy

Step 5: Lookup and receive results

- Tap “Lookup” button

- Corresponding tax code will display in first row of results table

Step 6: Save information

- Take screenshot to save information

- Can use immediately for necessary procedures

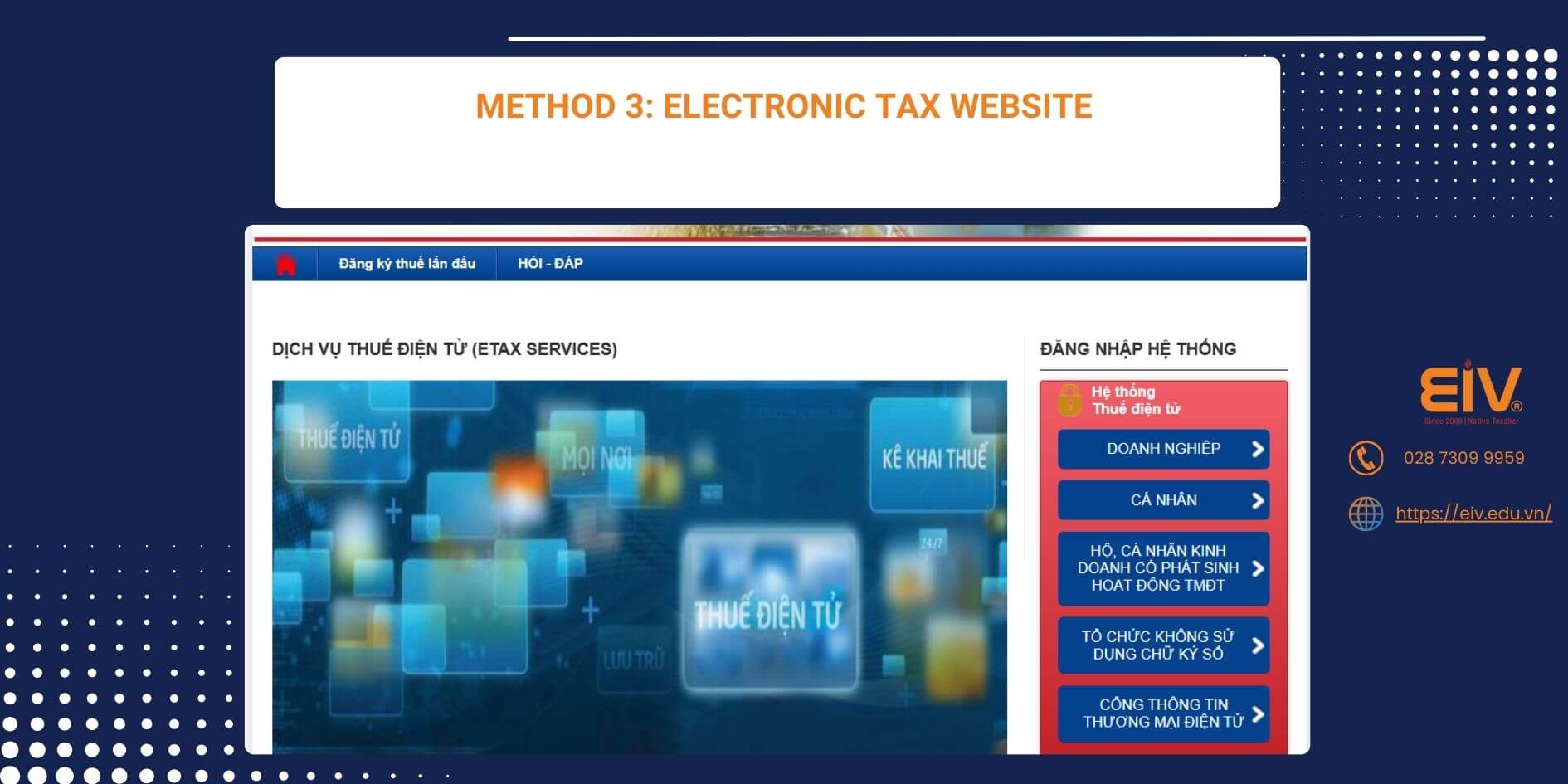

Method 3: Electronic Tax Website

The website https://thuedientu.gdt.gov.vn provides integrated electronic tax services, including tax code lookup for both individuals and enterprises. This is the official General Department of Taxation page for businesses and individuals to file taxes and register tax codes.

Detailed 4-Step Process

Step 1: Access and select target

- Visit: https://thuedientu.gdt.gov.vn

- Select “Individual” box on the right side

Step 2: Select lookup function

- Choose “Lookup taxpayer information” button

- Screen displays lookup form

Step 3: Fill information

- Document type: Choose “ID card/Citizen ID”

- Document number: Enter passport number or CCCD

- Verification code: Enter exactly as shown in image

Step 4: View results

- Click “Lookup” to view results

- Information displays complete tax code and status

Method 4: Third-Party Websites

The website masothue.com provides quick lookup requiring only CMND/CCCD or passport number, without complex verification codes. Masothue.com supports tax code lookup for 2 million businesses and individuals across 34 provinces and cities.

Simple 3-Step Process

Step 1: Access website

- Open browser and visit: https://masothue.com

- Select “Personal tax code lookup”

Step 2: Enter information

- Enter personal identification number (CMND/CCCD) or passport number in search box

- Click magnifying glass icon to perform lookup

Step 3: View detailed results Results include: tax code, individual name, address, managing tax office, tax participation date, and activity status. Can click “Update” to view latest information.

⚠️ Security note: This is a third-party website, consider personal information protection when using.

Method 5: Facebook Messenger Lookup

Facebook Messenger provides automatic tax code lookup service via chatbot, convenient for users familiar with social media. The “Tax Code” fanpage at https://www.facebook.com/masothuedotcom/ supports automatic lookup.

4-Step Messenger Process

Step 1: Access fanpage

- Visit link: https://www.facebook.com/masothuedotcom/

- Or search “Tax Code” on Facebook

Step 2: Start chat

- Click “Send message”

- Messenger window will open

Step 3: Send information

- Type CCCD/CMND or passport number in message

- Send message and wait for response

Step 4: Receive automatic results

- System will automatically return personal tax code information of sender

- Information includes tax code and taxpayer information

Warning: This is a third-party Facebook page, consider before using due to increased risk of personal information leakage.

Comparing 5 Methods – Which is Best?

The official General Department of Taxation website is the most recommended method due to high accuracy and good security, while the eTax Mobile app is most suitable for mobile lookup.

| Method | Accuracy | Speed | Security | Best For |

|---|---|---|---|---|

| General Dept. of Taxation Website | 100% | Medium | High | Official lookup |

| eTax Mobile | 100% | Fast | High | Mobile, frequent lookup |

| Electronic Tax | 100% | Medium | High | Multiple integrated services |

| Masothue.com | 95% | Very Fast | Medium | Quick, simple lookup |

| Facebook Messenger | 90% | Fast | Low | Social media users |

Usage Recommendations by Purpose

For new foreigners:

- First-time lookup: Use official website to ensure accuracy

- Regular lookup: Download eTax Mobile app for convenience

- Quick results needed: Use masothue.com (note security)

For accounting-finance staff:

- Bulk lookup: Electronic tax website has many utilities

- Regular checking: eTax Mobile for mobile lookup

- Information verification: Official website to ensure accuracy

Common Errors When Looking Up and Solutions

The “Information not found” error is the most common issue, usually caused by 4 main reasons and can be easily fixed.

Error 1: Incorrect Lookup Information Input

Causes and solutions:

- Entering wrong CMND/CCCD number, wrong captcha, or internet connection issues

- Solution: Double-check information and retry following proper instructions

- Verification code: Pay attention to distinguishing uppercase, lowercase, and numbers

Error 2: Tax Code Not Yet Registered

Signs and handling:

- Personal tax code not yet registered

- Solution: Register tax code with managing tax office where living/working

- Processing time: Usually 1-3 working days after submitting complete documents

- Detailed guidance: See Guide to Personal Tax Code Registration for Foreigners in Vietnam with step-by-step procedures and required documents

Error 3: Tax Code Locked

Causes and solutions:

- Tax code locked or temporarily suspended

- Solution: Contact tax office and prepare documents to request tax code reactivation

- Required documents: Request letter, CCCD/passport, related documents

Error 4: Information Not Updated

Common situation:

- Changed CMND/CCCD number and tax office system not yet updated with new number

- Solution: Update information with tax office by submitting Form 08-MST according to Circular 86/2024/TT-BTC

Special Case: “Mysteriously Having Tax Code”

Cases of individuals “mysteriously having personal tax code” may be due to CMND/CCCD being used by others to register tax code. Contact tax office immediately to check and handle.

E-ID for Foreigners from July 1, 2025 – New Information

From July 1, 2025, foreigners residing in Vietnam can register for VNeID level 2 E-ID accounts to perform online administrative procedures. The Ministry of Public Security launched a 50-day-and-night campaign (July 1 – August 19, 2025) to provide electronic identification for foreigners.

Benefits of Electronic Identification

Main utilities:

- Authenticate information in banking transactions, housing registration, public service usage

- Store electronic residence cards and legal documents on VNeID app

- Procedures: Online tax, insurance, banking

VNeID Registration Conditions

Eligible subjects:

- Foreigners aged 6 and above who have been issued permanent or temporary residence cards in Vietnam

- Required documents: Passport, Account request form (Form TK01), registered mobile number, email address

- Registration location: Immigration management offices, Provincial/City Public Security

Frequently Asked Questions About Foreign Personal Tax Codes

Do foreigners need to register separate tax codes?

Yes, foreigners must register separate tax codes when having income in Vietnam. According to Circular 86/2024/TT-BTC, individuals with income subject to personal income tax must register directly with tax offices. Registration can be done directly or through income-paying organizations.

Are foreign tax codes different from Vietnamese ones?

Yes, from July 1, 2025 there is a clear difference. Foreigners continue using separate 10-digit tax codes, while Vietnamese citizens switch to using 12-digit personal identification numbers. Foreign tax codes are issued through separate procedures and do not use the Ministry of Public Security’s identification system.

Why can’t I look up tax code on the system?

The most common reason is not yet registering for a tax code or information not fully updated. If you’ve tried everything but still can’t find information, you can call the General Department of Taxation hotline or visit the Tax Sub-department directly for assistance. Other cases include temporary system disruptions or personal information not synchronized.

Can I look up tax codes for others?

Yes, if you have their CMND/CCCD or passport number. However, comply with personal information protection regulations. Lookup websites commit to not sharing information with third parties and comply with privacy terms.

Do tax codes have expiration dates?

Personal tax codes are valid permanently. According to Clause 3, Article 30 of the 2019 Tax Administration Law, individuals are issued one unique tax code to use throughout their lifetime. However, activity status may change if tax obligations are not fulfilled or regulations are violated.

How much does tax code lookup cost?

Completely free on all official General Department of Taxation websites and apps. According to Decree 69/2024/ND-CP, foreigners do not pay fees for electronic identification account registration. Only fees apply when using consulting company support services.

Looking up personal tax codes for foreigners in Vietnam can be easily done through 5 main methods, with the official General Department of Taxation website being the most reliable choice. From July 1, 2025, foreigners continue using separate tax code systems and can utilize VNeID electronic identification for more convenient administrative procedures.

Mastering tax code lookup methods helps foreigners in Vietnam properly fulfill tax obligations and avoid unnecessary legal risks.

Hồ Chí Minh: 028 7309 9959 (Phím 1)

Hồ Chí Minh: 028 7309 9959 (Phím 1)